2022 (Q1): Battery-electric passenger car sales increased in almost every country in Europe but sales of plug-in hybrid cars were lower while petrol remained the most popular fuel type for new cars.

In the first quarter of 2022, the registration of electrically chargeable passenger vehicles in the European Union (EU), UK, and EFTA countries increased sharply. The sales of battery-electric cars increased by 61% for a record 10% market share while plug-in hybrid vehicle sales contracted by 6% for a 9% market share. Germany was by far the largest market for new battery-electric vehicles and plug-in hybrid cars in Europe.

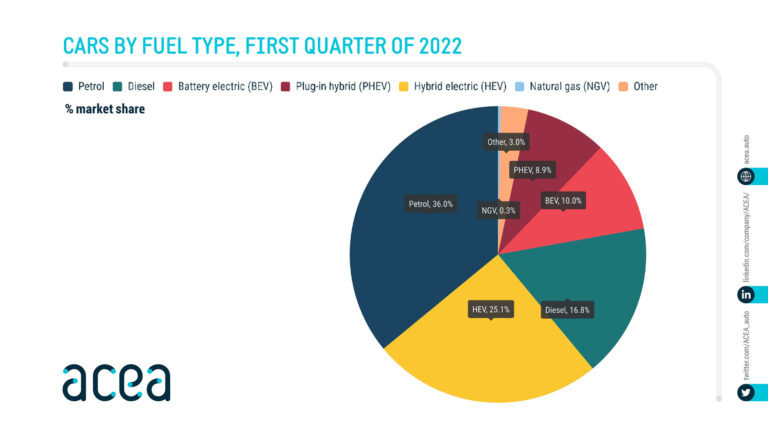

European New Car Market by Fuel Type in 2022 (Q1)

In the first quarter of 2022, electrified vehicles gained market share in the weak overall European new car market (EU, EFTA, and the UK). While the total European new car market was 11% weaker, electrically-chargeable vehicle (ECV) sales increased strongly with battery-electric vehicle (BEV) sales up 60.8%. Plug-in hybrid vehicles (PHEV) gained market share despite sales decreasing by 6.1%.

In the European Union (EU), new passenger vehicle registrations contracted by 12% to 2,245,976 cars during the first quarter of 2022. BEV sales increased by 53.4% to 224,145 cars (146,185 cars in 2021) for a market share of 10% (5.7% in 2021) while PHEV sales contracted by 5.3% to 199,107 cars and an 8.9% market share.

Although petrol car sales fell 22.6%, it remained by far the most popular fuel type for new cars with a 36% share (down from 42.2% in 2021(Q1) and 52.3% in 2020/Q1), while diesel sales were down 33.2% for a 16.8% share (23.2% in 2021/Q1 and 29.9% in 2020/Q1). The demand for diesel cars fell by 44% in France, 39% in Italy, 31% in Spain, and 20% in Germany.

The sales of hybrid electric vehicles (HEVs), which run mostly on petrol, increased 5% to 563,030 cars — the second most popular fuel type of new cars sold in Europe in the first three months of 2022 with a 25.1% share of the total new passenger vehicle market.

Battery-Electric Car Sales in Europe in 2022 (Q1)

Registrations of battery-electric vehicles (BEV) in various European Union and EFTA member countries during the period January to March 2022 were as follows according to ACEA statistics:

| Country | 2022 (Q1) | 2021 (Q1) | % Change 22/21 |

| Austria | 7,177 | 6,622 | +8.4 |

| Belgium | 9,641 | 4,039 | +138.7 |

| Bulgaria | 156 | 57 | +173.7 |

| Croatia | 247 | 132 | +87.1 |

| Cyprus | 67 | 26 | +157.7 |

| Czech Republic | 785 | 573 | +37.0 |

| Denmark | 5,952 | 2,991 | +99.0 |

| Estonia | 147 | 95 | +54.7 |

| Finland | 3,040 | 1,503 | +102.3 |

| France | 43,510 | 30,491 | +42.7 |

| Germany | 83,774 | 64,809 | +29.3 |

| Greece | 505 | 419 | +20.5 |

| Hungary | 1,273 | 560 | +127.3 |

| Ireland | 6,238 | 2,816 | +121.5 |

| Italy | 11,289 | 13,272 | -14.9 |

| Latvia | 156 | 68 | +129.4 |

| Lithuania | 257 | 66 | +289.4 |

| Luxembourg | 1,615 | 1,033 | +56.3 |

| Netherlands | 12,397 | 4,560 | +171.9 |

| Poland | 2,289 | 940 | +143.5 |

| Portugal | 3,699 | 1,579 | +134.3 |

| Romania | 2,108 | 415 | +408.0 |

| Slovakia | 302 | 157 | +92.4 |

| Slovenia | 553 | 342 | +61.7 |

| Spain | 7,253 | 3,449 | +110.3 |

| Sweden | 19,715 | 5,111 | +285.7 |

| EUROPEAN UNION | 224,145 | 146,125 | +53.4 |

| Iceland | 1,334 | 536 | +148.9 |

| Norway | 26,803 | 19,159 | +39.9 |

| Switzerland | 8,838 | 4,751 | +86.0 |

| EFTA | 36,975 | 24,446 | +51.3 |

| United Kingdom | 64,165 | 31,779 | +101.9 |

| EU + EFTA + UK | 325,285 | 202,350 | +60.8 |

| Source: ACEA |

Battery-Electric Car Sales in Europe in 2022 (Q1)

Battery-electric passenger vehicle registrations in Europe increased by 60.8% during the first quarter of 2022 with similar sales growth in the EU and EFTA but electric car sales doubling in the UK.

Germany was the largest battery-electric car market in Europe at the start of 2022 but sales increased by a below market average 29%. In Germany, as in other markets, demand for electric cars (and cars in general) far exceeded supply with waiting lists for new electric cars a minimum of three months and well over a year for the most popular models.

The British electric car market more than doubled and was again the second largest market in Europe for battery-electric vehicles. In France and Norway, the growth in electric car sales was around 40%.

The fastest-growing large market for battery-electric cars in Europe was Sweden where sales were up 286% during the first quarter of 2022. In the Netherlands, electric car sales increased by 172%.

Italy was the only country in Europe where battery-electric car sales were lower during the first quarter of 2022. This is largely due to a change in subsidies that were particularly generous during 2021 but suspended at the start of 2022.

Plug-In Hybrid Electric Vehicle Sales in Europe in 2022 (Q1)

Registrations of plug-in hybrid electric vehicles (PHEV) in various European Union, UK and EFTA member countries during the first quarter of 2022 were as follows according to ACEA statistics:

| Country | 2022 (Q1) | 2021 (Q1) | % Change 22/21 |

| Austria | 3,173 | 3,723 | -14.8 |

| Belgium | 15,222 | 12,785 | +19.1 |

| Bulgaria | 28 | 29 | -3.4 |

| Croatia | 210 | 69 | +204.3 |

| Cyprus | 34 | 29 | +17.2 |

| Czech Republic | 757 | 953 | -20.6 |

| Denmark | 5,547 | 7,518 | -26.2 |

| Estonia | 107 | 44 | +143.2 |

| Finland | 4,433 | 5,741 | -22.8 |

| France | 29,310 | 31,229 | -6.1 |

| Germany | 67,771 | 78,047 | -13.2 |

| Greece | 1,274 | 878 | +45.1 |

| Hungary | 1,269 | 918 | +38.2 |

| Ireland | 3,966 | 2,729 | +45.3 |

| Italy | 19,603 | 16,486 | +18.9 |

| Latvia | 56 | 29 | +93.1 |

| Lithuania | 233 | 56 | +316.1 |

| Luxembourg | 1,063 | 1,232 | -13.7 |

| Netherlands | 10,032 | 7,675 | +30.7 |

| Poland | 2,442 | 1,985 | +23.0 |

| Portugal | 3,919 | 3,405 | +15.1 |

| Romania | 0 | 0 | |

| Slovakia | 364 | 240 | +51.7 |

| Slovenia | 176 | 22 | +700.0 |

| Spain | 10,451 | 7,142 | +46.3 |

| Sweden | 17,667 | 27,278 | -35.2 |

| EUROPEAN UNION | 199,107 | 210,242 | -5.3 |

| Iceland | 787 | 542 | +45.2 |

| Norway | 2,338 | 10,632 | -78.0 |

| Switzerland | 4,998 | 4,315 | +15.8 |

| EFTA | 8,123 | 15,489 | -47.6 |

| United Kingdom | 29,761 | 26,613 | +11.8 |

| EU + EFTA + UK | 236,991 | 252,344 | -6.1 |

| Source: ACEA |

Plug-In Hybrid Car Sales in Europe in 2022 (Q1)

New plug-in hybrid passenger vehicle registrations in Europe contracted by 6.1% during the first quarter of 2022 while sales in the EU were down 5.3%.

In 2021, plug-in hybrid sales were helped by government incentives, especially in Germany, and the resulting increase in the availability of plug-in models on the market. However, continued doubts about whether plug-in hybrids contribute to lower emissions, and considerable anecdotal evidence that such hybrids actually increase on-the-road fuel consumption as company cars rarely get charged, convinced governments to reduce subsidies. For many private buyers, electric or petrol cars remained a far more sensible option at the start of 2022.

In the first quarter of 2022, Germany remained the largest market for PHEVs but sales were down 13%. Subsidies are likely to end in Germany at the end of 2022 and with manufacturers unable to guarantee deliveries in time, many buyers are less interested in these overly expensive cars.

PHEVs sales in the UK increased to move up to second place while sales were lower in France and Sweden. The only markets with significant gains were small countries where PHEV sales during the first three months of 2022 failed to exceed 250 cars.

Electric Car Sales in the European Union (EU) and EFTA Countries

Electric Car Sales per EU and EFTA Country:

- 2022: Q1

- 2021 (Full Year): By Country, Top Electric Brands and Models

- 2021: Q1, Half Year, Q3

- 2020 (Full Year): Market by Fuel Type, Sales by Country

- 2020: Q3, (Half Year), (Q1)

- 2019: (Full Year), (Q1)

- 2018: (Full Year), (Q3), (Half Year), (Q1)

- 2017: (Full Year)