In full-year 2025, new passenger vehicle registrations in Europe (EU, UK and EFTA) increased by 2.4% for the European car market to exceed 13 million car sales for the first time since 2019.

2025 (January to December): The European new car market expanded by 2.4% to almost 13.3 million passenger vehicle registrations. Although the highest annual sales in Europe in six years, the European new car market was still around 2.5 million vehicles smaller than in 2019.

The European new car market in 2025 expanded by 2.4% to 13,271,270 new passenger vehicle registrations. Germany was the largest European country market. Volkswagen was the largest carmaker and best-selling electric car brand. The Dacia Sandero was again the top-selling car model in Europe in 2025.

Latest European Car Market Statistics: 2025: January, February, March, (Q1), April, May, June (HY), July, August, September, October, November; 2024 (Full Year): Market, By Country, Electric, Brands, Top 50 Models, Top 20 Electric Models; 2025-2007.

European New Car Market in 2025 (Full Year)

In full-year 2025, new passenger vehicle registration in Europe (EU, EFTA, UK) grew 2.4% to 3,271,270 cars compared to 12,963,614 cars in 2024. The European new car market expanded for the third consecutive year, but total sales were still a good 2.5 million cars lower than in the years before 2020.

In the European Union (EU), new passenger vehicle registrations in 2025 grew by a more modest 1.8% to 10,822,831 cars (10,632,381 cars in 2024). Car sales in EFTA increased by 13% to 427.916 vehicles (up from 378,455). New car registrations in the United Kingdom increased by 3.5% to just over two million cars.

New Passenger Vehicle Registrations in Europe by Year

New passenger vehicle registrations in the European Union, Great Britain, and the EFTA countries were as follows from 2007 to 2025, based on ACEA data:

| Year | Sales EU, UK & EFTA | % Change |

| 2025 | 13,271,270 | 2.4 |

| 2024 | 12,963,614 | 0.9 |

| 2023 | 12,847,481 | 13.7 |

| 2022 | 11,286,939 | -4.1 |

| 2021 | 11,774,885 | -1.5 |

| 2020 | 11,961,182 | -24.3 |

| 2019 | 15,805,752 | 1.2 |

| 2018 | 15,624,486 | 0.0 |

| 2017 | 15,631,687 | 3.3 |

| 2016 | 15,131,719 | 6.5 |

| 2015 | 14,202,024 | 9.2 |

| 2014 | 13,006,451 | 5.4 |

| 2013 | 12,308,215 | -1.8 |

| 2012 | 12,527,912 | -7.8 |

| 2011 | 13,573,550 | -1.4 |

| 2010 | 13,785,698 | -4.9 |

| 2009 | 14,481,545 | -1.6 |

| 2008 | 14,712,158 | -7.8 |

| 2007 | 15,958,871 | 1.1 |

Note: Data does not necessarily include smaller new EU members for historical figures.

Car Sales in Europe by Month in 2025

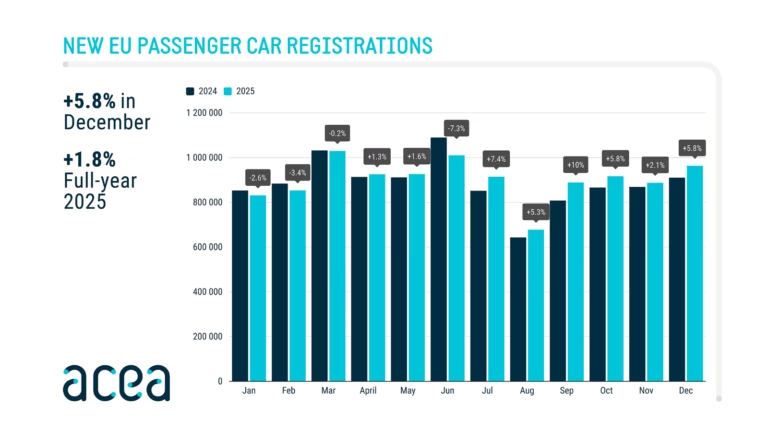

According to the ACEA, car sales in the European Union were as follows by month in 2025 and 2024:

In contrast to 2024, new car sales in the European Union (EU) expanded mostly during the second half of the year. More regulatory clarity on incentives for especially all-electric cars should assist the German new car market in 2026.

New Car Sales in the EU by Power Source

New car sales in the European Union by power source were as follows in 2025:

In 2025, battery electric car sales (BEV) in the European Union (EU) increased by 29.9% to 1,880,370 all-electric cars (1,447,934 all-electric cars in 2024 and 1,538,106 in 2023). Electric cars took a 17.4% share of tEU new car sales in 2025. Germany recovered its position as the largest market for battery-electric cars in Europe with 545,142 sales (+43%).

In EFTA, electric car sales increased by 42% with growth in all three countries. In the UK, electric car sales were up 24% to 473,348 cars — the second largest all-electric car market in Europe in 2025.

Europe Car Sales Statistics

→ Latest European Car Sales Statistics

- 2025 Market Analysis: January, February, March, April, May, June, July, August, September, October, November.

- 2025 (HY): Car & BEV Sales by Country, Electric Car Brands & Models, Brands, Top 10 Models.

- 2025 (Q1): Car Sales by Country, Best-Selling Brands, Electric Cars.

- 2025 (Outlook) Europe: Car and Electric Car Sales Forecasts.

- 2024 (Full Year): Market Analysis, Car Sales by Country, Electric Sales by Country, Best-Selling Brands, Top 50 Models, Top 20 Electric Models.

- 2024: January, February, March, April, May, June, July, August, September, October, November.

- Full-Year 2023: Car Sales by Country, Brands, Top 50 Models, Top 20 Electric Car Models.