First semester 2023: new passenger vehicle registrations in Europe (EU, EFTA and UK) increased by 17.6% with battery-electric car sales up in every European country during the first half of the year.

Car sales in Europe (EU, EFTA, UK) recovered by nearly 18% during the first six months of 2023 with almost all countries experiencing growth. Battery-electric vehicle (BEV) sales increased by 45% to take a 14.2% share of the European new car market in the first half of 2023. Germany remained by far the largest single-country car market in Europe followed by Britain, France, Italy, and Spain. The top markets for electric cars were Germany, the UK, France, and the Netherlands. Volkswagen remained the top carmaker and brand in Europe and the Tesla Model Y the top-selling car model during the first six months of 2023.

Latest European Car Market Statistics — 2024; 2023: By Country, Brands, Models, Electric Models and months: January, February, Q1, April, May, June (HY), July, August, September, Q3, October; 2022, 2021 & 2020.

European New Car Market in 2023 (First Half Year)

During the first half of 2023, new passenger vehicle registrations in Europe (including the European Union, EFTA countries, and the United Kingdom) increased by 17.6% to 6,588,937 cars compared to 5,601,386 cars sold during the first semester of 2022 and 6,486,351 cars during the first six months of 2021.

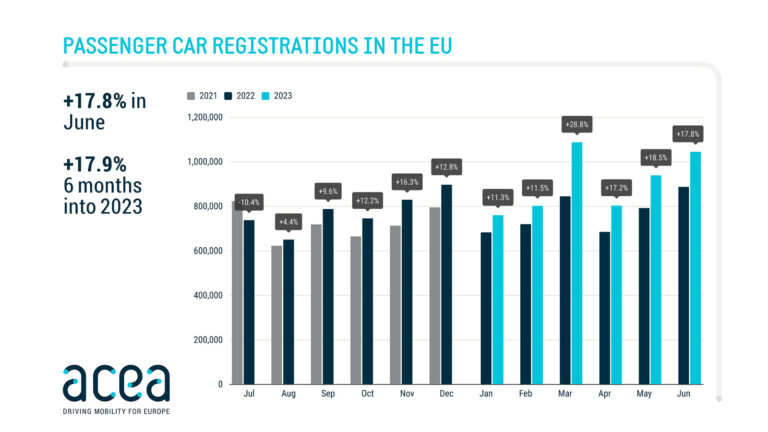

In the EU only, in the first half of 2023, new car registrations increased by 17.9% to 5.4 million units according to the ACEA. The recent months’ improvements indicated that the European automotive industry is recovering from supply disruptions caused by the pandemic. However, cumulative volumes are 21% lower compared to 2019. Most of the region’s markets grew significantly in the first six months of 2023, including the four largest ones: Spain (+24.0%), Italy (+22.8%), France (+15.3%), and Germany (+12.8%). Sales were only lower in Norway, Sweden, and Hungary.

Car sales in the EU have been increasing every month since August 2022 but there is increasing worry in the industry that backorders from the supply crisis in 2022 are being fulfilled and that demand will be lower towards the end of the year.

Battery-electric car sales took a 14.2% share of the new car market in Europe during the first half of 2023. All countries registered an increase in BEV sales with Norway, where battery-electric cars already have an 83% share of the total new car market, showing the slowest increase.

For full-year 2023, the VDA predicts that the European new car market will grow by 9% to around 12.3 million vehicles.

Car Sales Per Country in Europe in 2023 (First Half)

Car sales per European country (EU, EFTA, and UK) during the first six months of 2023 according to the ACEA were:

| Country | HY 2023 | HY 2022 | % 23/22 |

| EU + EFTA + UK | 6,588,937 | 5,601,386 | 17.6 |

| Austria | 126,690 | 108,606 | 16.7 |

| Belgium | 264,475 | 195,387 | 35.4 |

| Bulgaria | 17,633 | 14,539 | 21.3 |

| Croatia | 33,435 | 22,869 | 46.2 |

| Cyprus | 7,642 | 6,133 | 24.6 |

| Czech Rep | 115,548 | 98,914 | 16.8 |

| Denmark | 84,344 | 73,518 | 14.7 |

| Estonia | 12,131 | 11,074 | 9.5 |

| Finland | 46,873 | 43,500 | 7.8 |

| France | 889,776 | 771,980 | 15.3 |

| Germany | 1,396,870 | 1,237,975 | 12.8 |

| Greece | 70,362 | 54,798 | 28.4 |

| Hungary | 56,467 | 57,407 | -1.6 |

| Ireland | 77,496 | 65,211 | 18.8 |

| Italy | 840,750 | 684,393 | 22.8 |

| Latvia | 9,903 | 8,141 | 21.6 |

| Lithuania | 14,680 | 13,982 | 5.0 |

| Luxembourg | 26,494 | 21,812 | 21.5 |

| Malta | 3,970 | 3,342 | 18.8 |

| Netherlands | 201,792 | 153,697 | 31.3 |

| Poland | 238,672 | 212,405 | 12.4 |

| Portugal | 110,155 | 75,743 | 45.4 |

| Romania | 73,645 | 58,712 | 25.4 |

| Slovakia | 45,457 | 39,953 | 13.8 |

| Slovenia | 27,310 | 25,847 | 5.7 |

| Spain | 505,421 | 407,758 | 24.0 |

| Sweden | 140,663 | 144,182 | -2.4 |

| EUROPEAN UNION | 5,438,653 | 4,611,878 | 17.9 |

| Iceland | 10,263 | 9,327 | 10.0 |

| Norway | 66,549 | 68,502 | -2.9 |

| Switzerland | 123,752 | 109,600 | 12.9 |

| EFTA | 200,564 | 187,429 | 7.0 |

| United Kingdom | 949,720 | 802,079 | 18.4 |

| EU + EFTA + UK | 6,588,937 | 5,601,386 | 17.6 |

Electric Car Sales Per Country in Europe in 2023 (First Half)

Battery-electric vehicle (BEV) sales per European country (EU, EFTA, and UK) during the first six months of 2023 according to the ACEA were:

| Country | BEV 2023 | BEV 2022 | % 23/22 BEV |

| EU + EFTA + UK | 938,912 | 647,371 | 45.0 |

| Austria | 23,372 | 14,493 | 61.3 |

| Belgium | 43,578 | 17,187 | 153.6 |

| Bulgaria | 879 | 337 | 160.8 |

| Croatia | 920 | 458 | 100.9 |

| Cyprus | 308 | 138 | 123.2 |

| Czech Rep | 3,008 | 1,971 | 52.6 |

| Denmark | 26,173 | 12,156 | 115.3 |

| Estonia | 644 | 359 | 79.4 |

| Finland | 15,300 | 5,950 | 157.1 |

| France | 137,919 | 93,331 | 47.8 |

| Germany | 220,244 | 167,263 | 31.7 |

| Greece | 3,212 | 1,286 | 149.8 |

| Hungary | 2,865 | 2,265 | 26.5 |

| Ireland | 14,297 | 8,446 | 69.3 |

| Italy | 32,673 | 24,942 | 31.0 |

| Latvia | 901 | 411 | 119.2 |

| Lithuania | 1,009 | 586 | 72.2 |

| Luxembourg | 5,284 | 3,211 | 64.6 |

| Malta | 579 | 462 | 25.3 |

| Netherlands | 58,272 | 29,499 | 97.5 |

| Poland | 8,495 | 4,807 | 76.7 |

| Portugal | 17,074 | 7,737 | 120.7 |

| Romania | 6,998 | 4,460 | 56.9 |

| Slovakia | 1,086 | 664 | 63.6 |

| Slovenia | 2,164 | 1,060 | 104.2 |

| Spain | 23,893 | 14,335 | 66.7 |

| Sweden | 52,439 | 39,753 | 31.9 |

| EUROPEAN UNION | 703,586 | 457,567 | 53.8 |

| Iceland | 3,923 | 2,405 | 63.1 |

| Norway | 55,274 | 54,158 | 2.1 |

| Switzerland | 23,164 | 17,992 | 28.7 |

| EFTA | 82,361 | 74,555 | 10.5 |

| United Kingdom | 152,965 | 115,249 | 32.7 |

| EU + EFTA + UK | 938,912 | 647,371 | 45.0 |

Largest Country Car Markets in Europe in 2023 (Half Year)

Germany remained by far the largest car market in Europe during the first half of 2023 and the only country in Europe where new passenger vehicle registrations exceeded a million cars. The UK was the second largest car market followed by France.

New car sales increased faster in Italy and Spain compared to the three largest markets. Car sales in Belgium and the Netherlands increased by around a third with both countries also experiencing very high increases in electric car sales. While the Netherlands was only the eighth largest country car market in Europe thus far in 2023, it was the fourth largest market for battery-electric vehicles.

Volkswagen remained the largest carmaker in Europe during the first half of 2023 with the group increasing its market share to above a quarter and VW by far the largest car brand in the EU. The Tesla Model Y was the top-selling car model in Europe during the first six months of 2023.

Europe Car Sales Statistics

→ Latest European Car Sales Statistics

- Full-Year 2023: Car Sales by Country, Brands, Top 50 Models, Top 20 Electric Car Models

- Car Sales and Market Analysis 2023: January, February, Q1, April, May, June HY, July, August, September, October.

- 2023 (Q3): Car Sales by Country, Brands

- Half-Year 2023: Car Sales by Country, Brands, Models

- Full-Year 2022: Car Sales by Country, Brands, Models, Electric