In the first half year 2023, new car sales in Europe increased by 17% with the Tesla Model Y the best-selling car model in Europe.

New passenger vehicle registrations in Europe (EU, EFTA, UK) increased by 18% in June 2023 and 17% during the first half of the year. Volkswagen remained the largest carmaker in Europe followed by Toyota and Audi. Tesla and MG gained the most market share during the first six months of 2023. The Tesla Model Y was Europe’s favorite battery-electric car and also the top-selling car model overall in June and the first half year 2023.

Latest European Car Market Statistics 2023: By Country, Brands, Models, Electric Models and months: January, February, Q1, April, May, June (HY), July, August, September, Q3, October; 2022, 2021 & 2020.

European New Car Market in 2023 (June and Half Year)

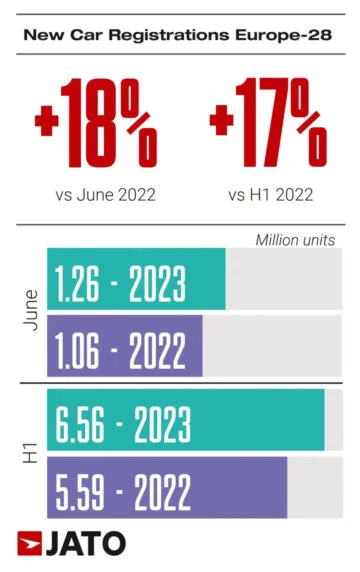

June 2023, was the 11th consecutive month of increases in new passenger vehicle registrations in Europe (EU, EFTA, UK). Car sales increased by 18% to 1.26 million vehicles.

According to JATO data across 28 European markets, car registrations during the first half of 2023 increased to the highest level since the market collapsed during the Covid-19 pandemic. During the first semester of 2023, European car registrations totaled 6.56 million units with growth in all but three European countries.

The European new car market thus expanded by 976,000 vehicles during the first half of 2023 compared to H1 2022, and 80,000 units from the same period in 2021. However, the results for 2023 so far were not as high as those in H1 2019 and 2018, with 1.86 million and 2.13 million more units registered respectively in those years.

Felipe Munoz, Global Analyst at JATO Dynamics, commented: “Although registrations are slowly rising again, difficulties with supply chain, as well as other post-pandemic factors, means that the market won’t return to the same state that it was in before 2020 for a while.” A major barrier to reaching those higher volumes is the accessibility of electric vehicles and their higher prices.

There is also increasing speculation in the automotive industry that demand will be lower in the coming months while delayed production is catching up fast. Volkswagen for example announced longer factory holidays than planned and discounting is again used in many markets. For full-year 2023, the VDA predicts that the European new car market will grow by 9% to around 12.3 million vehicles.

Best-Selling Car Brands in Europe in 2023 (Half Year)

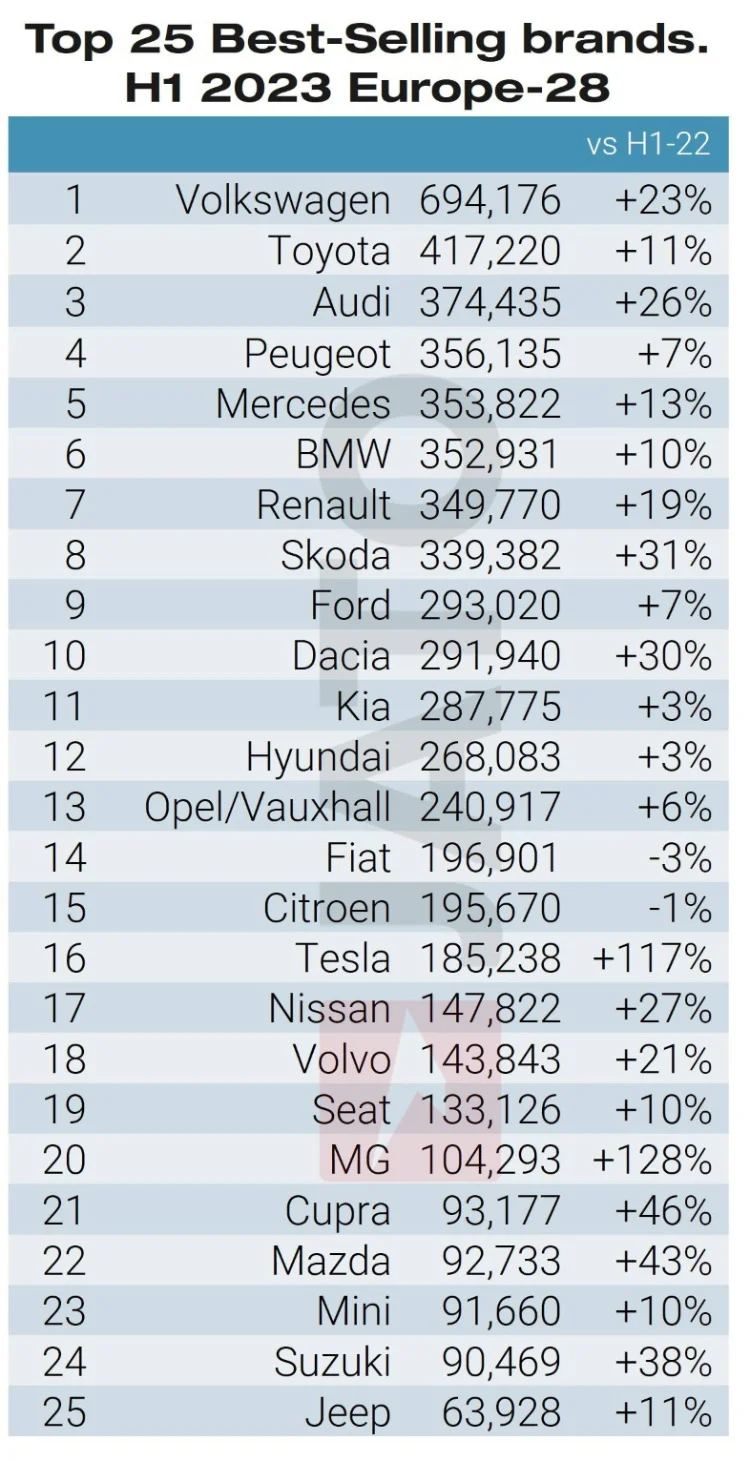

Volkswagen remained by far the largest car brand in Europe during the first half of 2023 while Toyota was again second despite losing market share. Audi improved from sixth to third with Peugeot and BMW slipping down one position each.

Tesla and MG benefited from the growth in electric car sales and were the two most improved brands in Europe during the first half of 2023. However, Skoda, which was more affected by the supply issues during the first half of 2022 than most other marques, and Volkswagen also increased sales strongly.

The worst-performing brands were Fiat, Kia, Hyundai, Citroen, and Peugeot, which clearly hit Stellantis sales hard, although the company claims to focus more on profitability than sales volume at the moment.

See 2023 (Half Year) Europe: Best-Selling Car Manufacturers and Brands for a full breakdown of sales by top carmakers in Europe.

Chinese Car Sales in Europe in 2023 (First Half)

Recently, MG has also been shaking the European car market. Once a British brand, all of its current cars are designed, developed, and produced by SAIC, one of China’s biggest OEMs. With 104,300 units registered in the first semester of 2023, MG outsold other major brands such as Mini, Cupra, and Jeep. Partly due to the success of the MG 4, its volume grew by 128% since the first half of 2022, providing MG with the second-highest market share increase in the first half of 2023.

Munoz, added: “MG is using both the notoriety of the brand in the West, and the competitiveness of the Chinese market, to its advantage. Its appealing, modern, and affordable electric cars in both Western and Eastern markets is a good showcase of how Chinese manufacturers can gain more traction and shift perceptions of their products.”

Aside from MG, China’s carmakers are gaining traction less quickly than analysts anticipated. Munoz, continued: “The dominating narrative at the moment is around the big potential of Chinese manufacturers in Europe. The potential is certainly there, but the volume of registrations are not currently reflecting that.” J

ATO’s data shows that of the 26 Chinese-made cars that sell in Europe, 43,101 units have been registered between January and June 2023, amounting to just a 0.66% market share (excluding MG). Nonetheless, they still experienced growth – they had just 0.43% market share during the same period in 2022. Including MG, the market share of Chinese OEMs is 2.25% or 147,394 cars.

Munoz, added: “It is not easy to continuously grow in such a competitive market, particularly when the brand is unknown and the product needs time to become popular with consumers. The perception of cars by Chinese manufacturers in the West needs to shift in order to see growth.”

Top-Selling Car Models in Europe in 2023 (First Half Year)

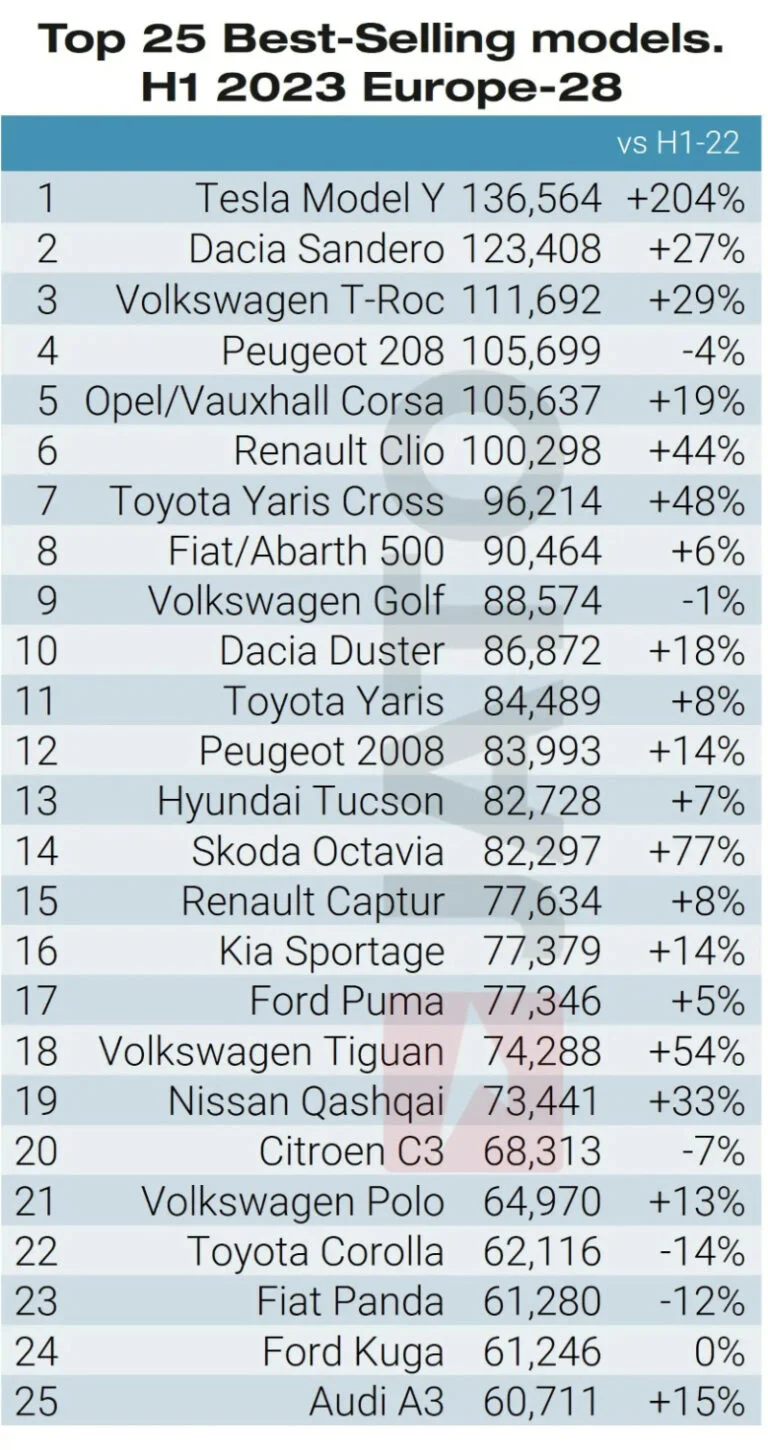

Since September 2022, the Tesla Model Y has climbed the monthly European model ranking, topping the list in November, December, February, March, and June. The gap between the first and second positions in the overall rankings for both Q1 and H1 2023 has widened from 11,481 units to 13,156 units. The Model Y ranked first in Denmark, Netherlands, Norway, Sweden, and Switzerland. It was most popular in Norway, where almost 1 in 4 of new cars registered were Tesla Model Ys.

The Dacia Sandero remained second on the European ranking, with registrations up by 27% to 123,400 units. Interestingly, it is virtually the antithesis of the Model Y – a combustion-powered, small, cheaper hatchback. Its place as second in the overall ranking indicates the income differences across regions. In France, for example, the Tesla Model Y was almost €37,000 (or 231%) more expensive than the Dacia Sandero.

The Skoda Octavia also experienced a big market share increase from the first semester 2022 to the same period in 2023. This was followed by the Dacia Jogger, Toyota Yaris Cross, Renault Clio, Volkswagen Tiguan, Renault Megane, MG ZS, Volkswagen ID.3 and ID.4, and Ford Focus.

In contrast, the models that saw the largest declines in sales volumes during the first half of 2023 were the Toyota RAV4, Peugeot 208, Toyota Corolla, Opel/Vauxhall Crossland, Fiat Panda, Citroën C3, Peugeot 3008, Volkswagen Golf, Renault Zoe, and Kia Niro.

Europe’s Favorite Electric Car Models in 2023 (First Semester)

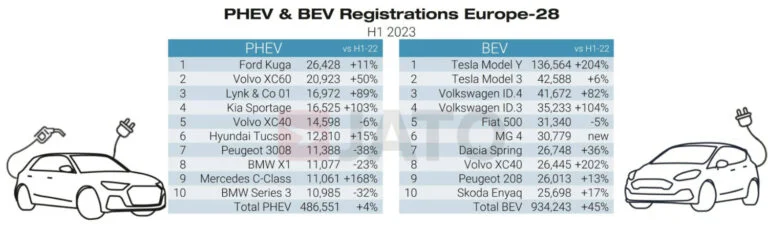

Tesla was the best-seller within the BEV market in both June and the first half year 2023 with 48,200 vehicles registered in June 2023 – doubling the volume recorded during the same period a year previously. The Tesla Model Y drove the continued popularity of the brand, becoming Europe’s best-selling passenger car in June and H1 2023, as well as reigning as the world’s most popular car in Q1 of the year.

In June 2023, Tesla registered more new cars than other mainstream brands like Opel/Vauxhall, Citroën, or Fiat, with the volume of the Model Y and Model 3 growing by 95% and 117% respectively. Tesla’s performance in June enabled the OEM to achieve the biggest market share increase.

Tesla’s market share soared by 1.3 percentage points between H1 2022 and H1 2023, rising from 1.53% to 2.82% – the biggest increase among the 116 brands tracked by JATO in Europe. Tesla’s success has grown rapidly over the last few years, considering that its market share in H1 2019 amounted to just 0.54%. Munoz noted: “The increase in availability of cars following the start of local production in Germany, as well as price cuts, explains Tesla’s rapid growth recently. It’s also important to note that Tesla represents EVs for many all over the world, and today more and more people are turning electric.”

Europe Car Sales Statistics

→ Latest European Car Sales Statistics

- Full-Year 2023: Car Sales by Country, Brands, Top 50 Models, Top 20 Electric Car Models

- Car Sales and Market Analysis 2023: January, February, Q1, April, May, June HY, July, August, September, October.

- 2023 (Q3): Car Sales by Country, Brands

- Half-Year 2023: Car Sales by Country, Brands, Models

- Full-Year 2022: Car Sales by Country, Brands, Models, Electric