In May 2023, new car sales in Europe increased by 18% but new passenger registrations were still lower than in 2019.

New passenger vehicle registrations in Europe (EU, UK, EFTA) increased by 18% in May 2023 to 1.1 million cars. In the European Union (EU) sales increased for the tenth consecutive month. Battery electric vehicle sales in Europe increased by nearly two-thirds to take a 15% market share. The Volkswagen Group was the largest producer of cars and battery-electric vehicles in Europe in May 2023 but Tesla was the top-selling eclectic car brand and the Model Y was again Europe’s favorite electric car. The Dacia Sandero was the top-selling car model in Europe in May 2023.

Latest European Car Market Statistics 2023: By Country, Brands, Models, Electric Models and months: January, February, Q1, April, May, June (HY), July, August, September, Q3, October; 2022, 2021 & 2020.

European New Car Market in 2023 (May)

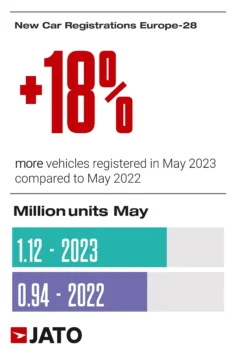

New passenger vehicle registrations in 28 European markets (EU, UK, EFTA) monitored by JATO Dynamics data increased by 18% to 1,116,472 cars in May 2023 compared to only 943,435 cars in May 2022. This takes the year-to-date total to 5.3 million units, up by 17%.

Felipe Munoz, Global Analyst at JATO Dynamics, commented: “While BEVs and SUVs continue to drive the recovery of the industry, growth across all segments has not been enough to bring total volume back to pre-pandemic levels.”

Total new car sales volume year-to-date 2023 in Europe fell short of the 6.93 million units registered in the same period in 2019 and was similar to the levels seen in 2021 when markets were still recovering from lockdowns and were hit by the semiconductor shortage.

New Passenger Vehicle Registrations in the European Union in May 2023

New passenger vehicle registrations in the European Union (EU) expanded by a slightly higher 18.5% to 938,950 cars in May 2023 compared to only 792,215 in May 2022. This was the tenth consecutive month of car sales growth in the EU. All the EU’s four largest markets grew, with the strongest gains in Italy (+23.1%), Germany (+19.2%), and France (+14.8%).

From January to May 2023, the EU car market grew by 18%, to 4.4 million registered cars. Although the market improved in May, year-to-date sales are still 23% lower compared to the same month in 2019, when 5.7 million units were registered. In this five-month period, there were double-digit gains in most markets, including the four largest: Spain (+26.9%), Italy (+26.1%), France (+16.3%), and Germany (+10.2%).

New Car Sales by Fuel Type in the European Union in May 2023

In May 2023, the market share of battery electric (BEV) cars in the European Union sales saw a substantial increase from 9.6% to 13.8%. Hybrid electric cars are now the second-most popular choice for new car buyers, accounting for almost a quarter of the market. However, petrol cars still have the largest share at 36.5% (plus hybrids and PHEVs that often run on fuel too). Diesel cars now account for 14.3% of the EU market share, down from 17.4% in May 2022.

New registrations of battery electric cars in the EU experienced a significant increase of 70.9% in sales in May 2023 to reach 129,847 units. This equates to a market share of 13.8%, and a four-percentage-point increase compared to May 2022. Most EU markets recorded double- and triple-digit percentage gains, including the four largest: the Netherlands (+118.4%), Sweden (+82.6%), France (+48.7%), and Germany (+46.6%). Overall, this resulted in a cumulative increase of 50.5%, with over half a million units sold from January to May 2023.

Best-Selling Car Brands in Europe in May 2023

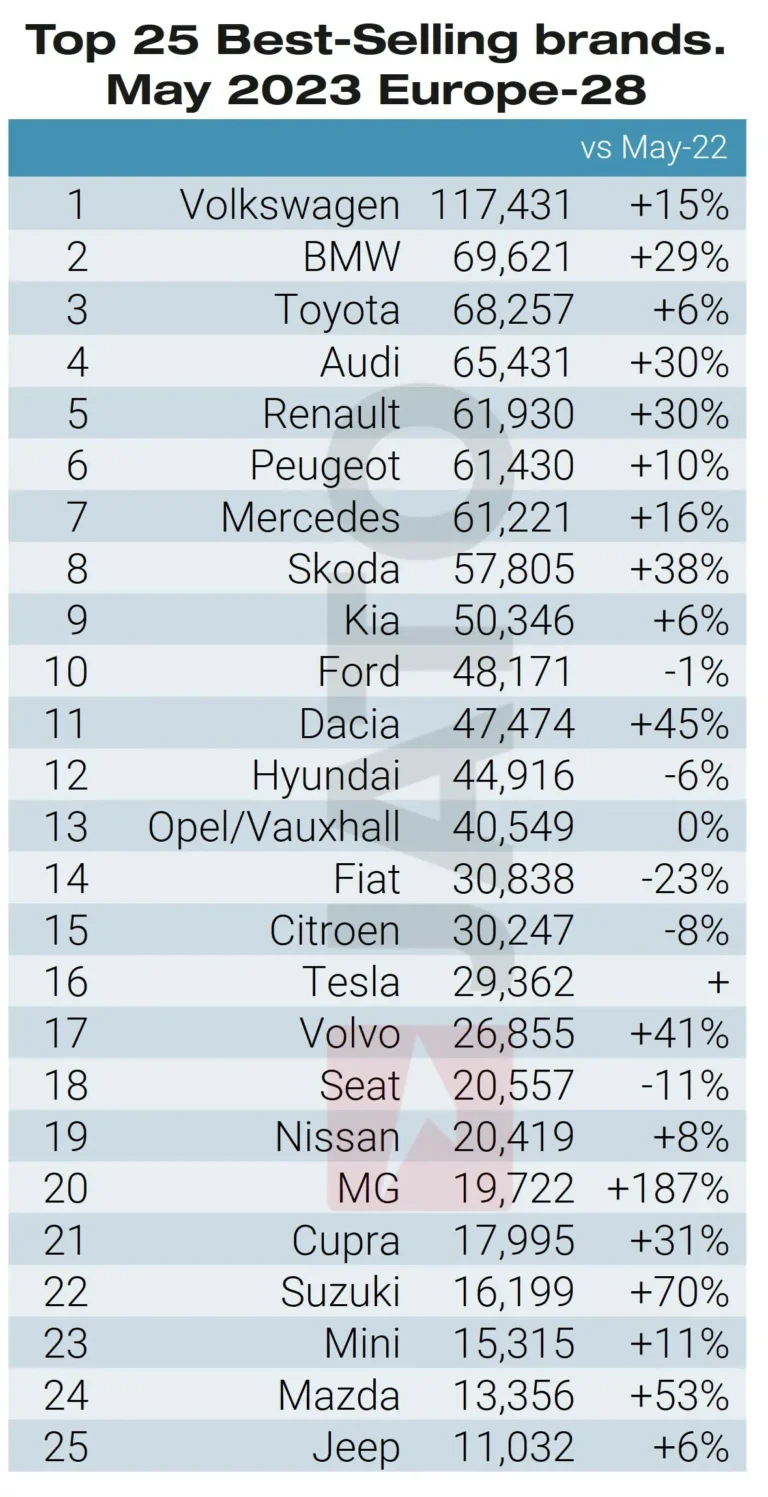

The 25 best-selling car marques in Europe (EU, UK, EFTA) in May 2023 were according to Jato:

In May 2023, Volkswagen remained by far the largest car brand in Europe but the competition for the other top ten places was much stronger. BMW moved into second place ahead of Toyota which lost market share. Audi was fourth increasing sales by nearly a third.

Renault also had a strong performance to move ahead of Peugeot and Mercedes-Benz. Skoda was the most improved top-ten brand in Europe in May 2023 while FOrd was the only top brand with weaker sales.

Tesla Car Sales in Europe in May 2023

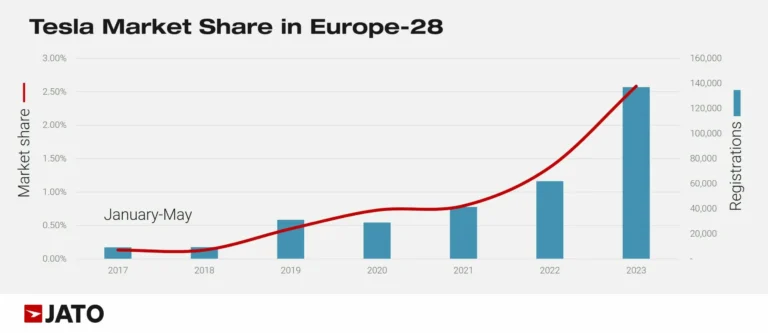

In May 2023, although only the 16th largest car brand in Europe, Tesla was the best-performing OEM winning 2.63% of the market with sales up by 1912% compared to May 2022. In May 2022, the US manufacturer’s market share was just 0.15%, however, this was due to supply issues which caused registrations to drop.

Tesla registered close to 29,400 units in May 2023, significantly higher than the monthly total seen in May 2021 (8,810 units), May 2020 (2,757 units), and May 2019 (4,087 units). Munoz, added: “By making use of incentives and good market position, Tesla has been able to outperform its rivals, while part of the brand’s success is also explained by continuous price cuts.”

During the first five months of 2023, Tesla sold 137,076 cars in Europe — a 121% increase. In comparison, the market leader Volkswagen Group increased sales by only 25% to 1,267,273 cars.

Top-Selling Electric Cars in Europe in May 2023

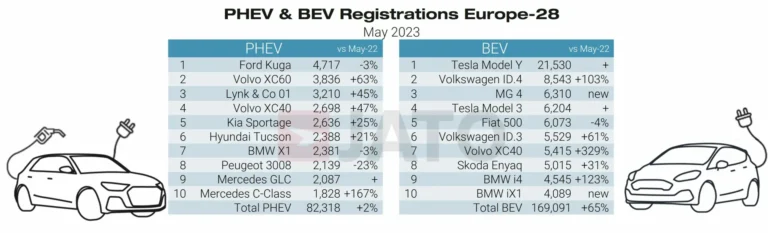

The following were according to JATO the top-selling battery electric (BEV) and plug-in hybrid (PHEV) cars in Europe in May 2023:

In the BEV segment, Tesla’s market share in Europe totaled 17.4% in May 2023 and 18.9% year-to-date 2023, up from 12.2% in the same period last year – the largest market share increase by a significant margin of 6.7 points. SAIC, the owner of MG and Maxus, followed with an increase of 2.8 points, and in third place, Volkswagen Group secured a market share increase of 2.7 points. In contrast, Hyundai-Kia lost 5.6 points of share through May, followed by Stellantis, down by 3.4 points.

Total BEV registrations in Europe increased by 65% in May 2023 to 169,091 units accounting for 15% of all new vehicle registrations during the month. In addition to the success of the Model Y – Europe’s best-selling car between January and May 2023 – the market is also being shaken by the MG 4, which secured a record third position in the BEV ranking by model with 6,310 units, ahead of its rival the Volkswagen ID.3 with 5,529 units. The Volkswagen ID.4 also performed well with 8,543 units (+103%) as the second most popular BEV of the month. There were also strong increases for the Volvo XC40 BEV (+329%), BMW i4 (+123%), and the BMW iX1, all of which entered the top in the BEV ranking by model in May.

However, Volkswagen’s sales of battery electric cars are below expectations with longer factory holidays and shorter shifts recently announced for the VW Emden plant where the ID4 is produced.

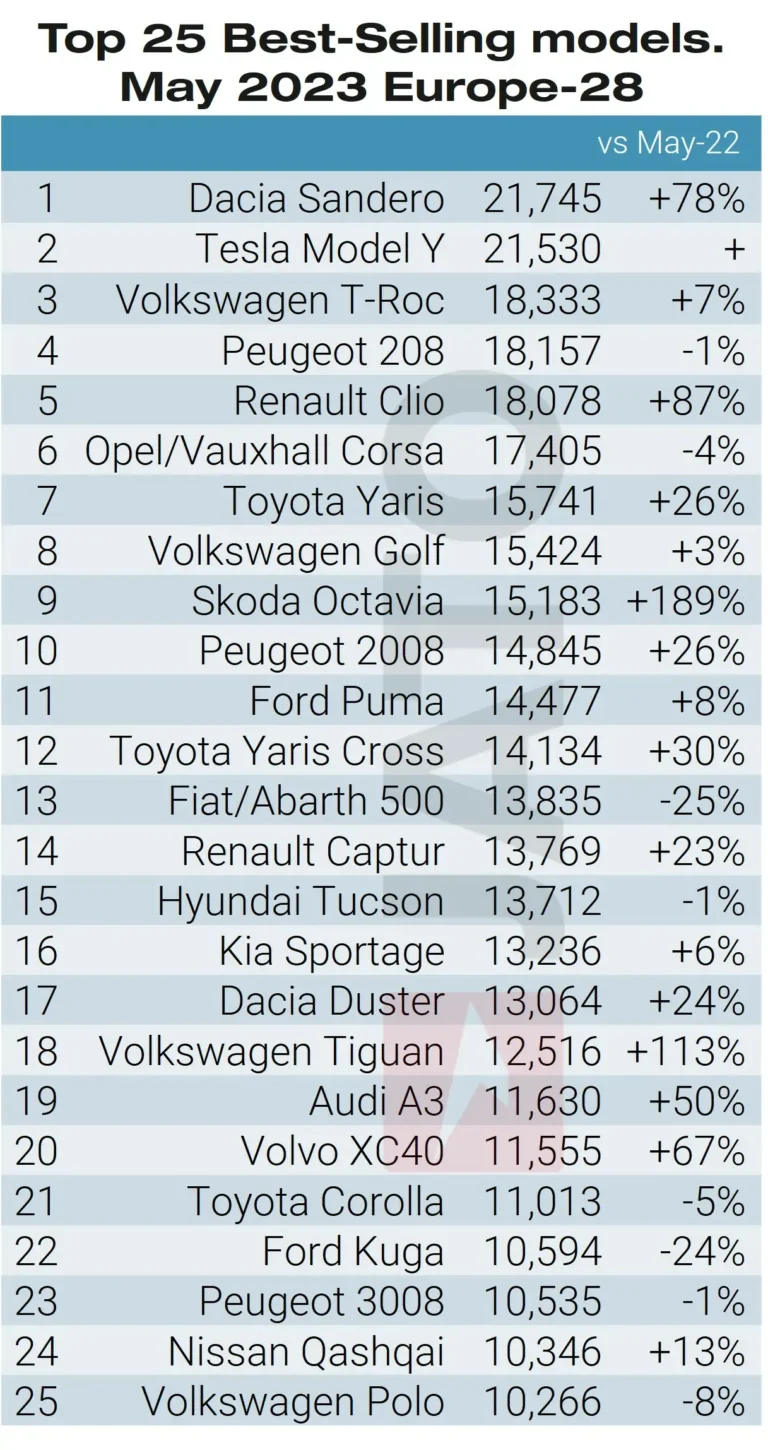

Top-25 Best-Selling Car Models in Europe in May 2023

The following were according to JATO the top-selling car models in Europe in May 2023:

In May 2023, the low-cost model from Dacia again secured the top spot in the overall ranking by model in Europe with more than 21,700 units – up by 78% with sales boosted by strong increases in key markets including France, Italy, Spain, and Germany. Munoz, continued: “While the Model Y plays its role in the electric high-end EV segments, the Sandero has continues to gain traction in the low-end ICE segments.” This segment has immense growth potential as more brands try to move cars upmarket.

The Tesla Model Y followed in second place with 21,530 units, up by 1838% compared with May 2022. Munoz, added: “The popularity of the Model Y has been confirmed in Europe, and it stands a good chance of leading both the European and global ranking model ranking by the end of the year.”

Both the Renault Clio and Skoda Octavia increased sales strongly compared to a year ago. In contrast, Peugeot 208 and Opel Corsa sales were lower.

Among the latest launches, Renault registered 7,174 units of the Austral, becoming the brand’s fourth best-selling vehicle; Jeep registered 4,290 units of the Avenger, offsetting the drops posted by the Compass (-41%) and Renegade (-32%), to become its best-seller in May; Alfa Romeo registered 3,240 units of the Tonale, accounting for 69% of the brand’s total volume; and Peugeot registered 1,923 units of the 408.

Europe Car Sales Statistics

→ Latest European Car Sales Statistics

- Full-Year 2023: Car Sales by Country, Brands, Top 50 Models, Top 20 Electric Car Models

- Car Sales and Market Analysis 2023: January, February, Q1, April, May, June HY, July, August, September, October.

- 2023 (Q3): Car Sales by Country, Brands

- Half-Year 2023: Car Sales by Country, Brands, Models

- Full-Year 2022: Car Sales by Country, Brands, Models, Electric