July 2023: Car sales in Europe increased by 17% with the European new passenger vehicle market expanding 12 months in a row.

Passenger vehicle registrations in the European Union, EFTA, and the UK expanded by 17% in July 2023 to mark a year of monthly car sales increases in Europe. Electric car sales increased by nearly two-thirds. The Volkswagen Group strengthened its position as Europe’s leading carmaker while Stellantis slipped further behind. Volkswagen was also the top-selling car brand in Europe in July 2023 with the VW T-Roc the best-selling car model and the Tesla Model Y Europe’s favorite battery-electric car.

Latest European Car Market Statistics — 2024; 2023: By Country, Brands, Models, Electric Models and months: January, February, Q1, April, May, June (HY), July, August, September, Q3, October; 2022, 2021 & 2020.

European New Car Market in July 2023

In July 2023, new passenger vehicle registration in Europe (EU, EFTA, and UK) increased by 17% — the 12th consecutive month of positive year-on-year growth in Europe. After just over a year of monthly decline – between July 2021 and July 2022 – the market has been on a positive trajectory since August 2022.

In total, 1,018,403 new passenger cars were registered in July 2023, compared to 873,825 units in July 2022. The year-to-date volume increased from 6,460,730 units in 2022 to 7,581,537 in 2023 – marking the highest result since the Covid-19 pandemic took hold.

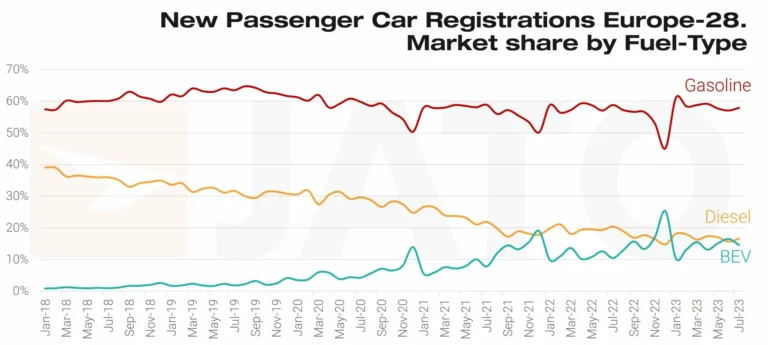

Car Sales in Europe by Fuel Type in 2023 (July)

In July 2023, both electric and petrol cars experienced strong growth in sales in Europe. Although BEVs (battery electric vehicles) saw an increase of 62% in July, gasoline cars also experienced significant sales. The demand for gasoline cars increased by 15% in July 2023 to 589,705 units – accounting for 58% of total cars sold in July.

Felipe Munoz, Global Analyst at JATO Dynamics, commented: “Despite BEVs being incentivized by governments and penalties enforced for those that use certain combustion engine cars, consumers are continuing to buy the latter. Gasoline cars are being sold at a similar rate to last year – with less than a percentage point difference between their market share in July 2022. It’s therefore clear that consumers still have concerns and remain reluctant to fully invest in new energy vehicles.”

Several factors account for this continued popularity, in particular, the difference in price points. The average retail price of electric passenger cars available in Germany in H1 this year was 39% higher than their gasoline counterparts (although this comparison excludes significant incentives and discounts for electric car registrations). A lack of available BEV models is also a key challenge – with 109 BEV and 297 gasoline models on offer in Germany. Munoz, continued: “The industry needs to do more if we are to see BEVs compete and succeed alongside familiar, long-standing gasoline cars. Regulation alone can’t achieve this– heightened awareness and fairer prices will be required if we’re to drive greater BEV adoption.”

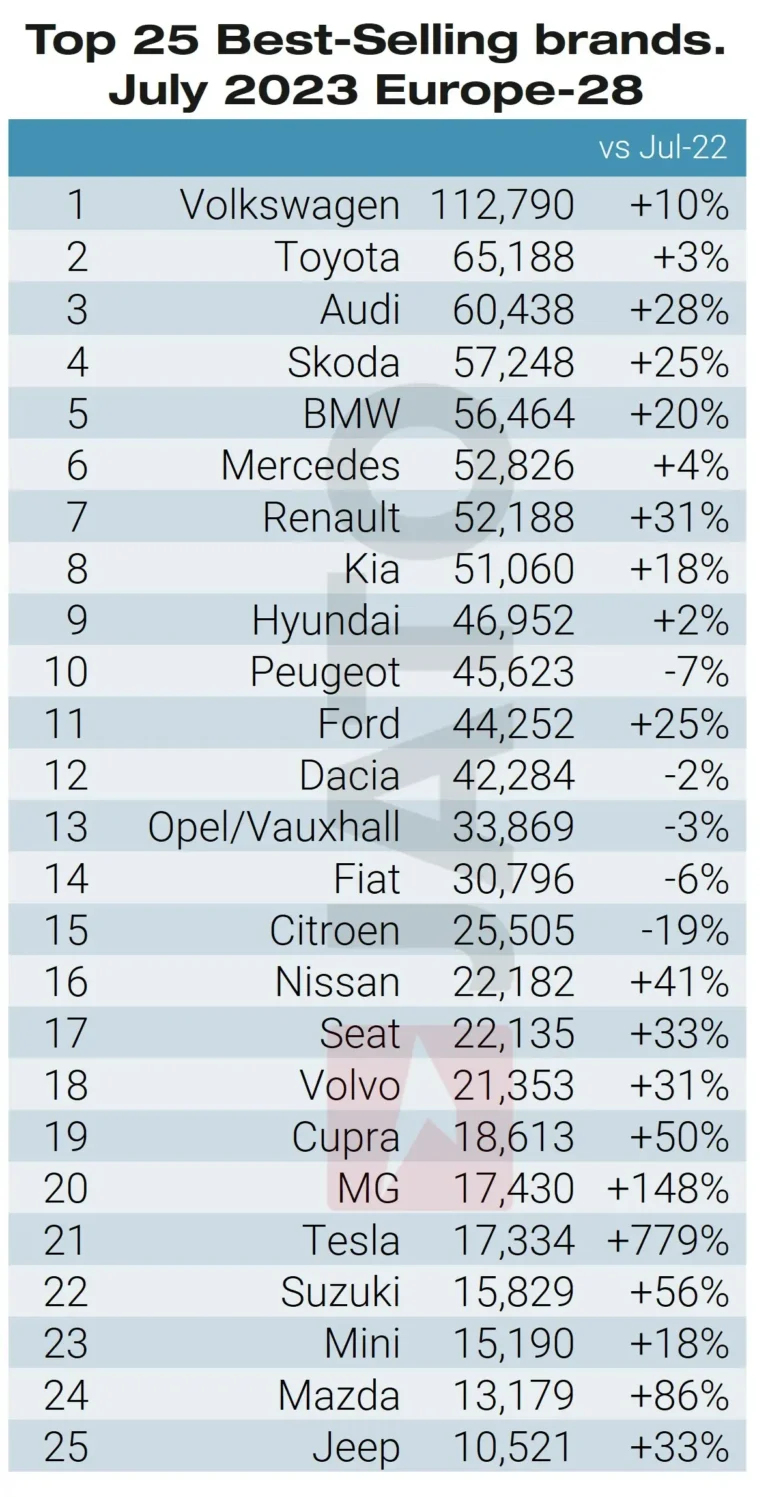

Best-Selling Car Brands in Europe in 2023 (July)

The 25 top-selling car marques in Europe in July 2023 were:

Top-Selling Carmakers in Europe in July 2023

As the shift to electric continues to be the priority for the European car industry, some OEMs are using the evolving market conditions to their advantage, in particular, the Volkswagen Group. Currently, VW’s growth is primarily driven by its ICE (internal combustion engine) and PHEV (plug-in hybrid electric vehicle) models such as the Skoda Octavia, Volkswagen Tiguan, Polo, Audi A3, and Cupra Formentor.

The Volkswagen ID.4 was the manufacturer’s best-selling BEV in July. However, it only took 8th place overall during the month and was the 13th best seller between January and July 2023. Munoz, noted: “The German manufacturer gained 0.8 points of share in July, moving up to 27.49% – marking its highest monthly market share in two years. It’s interesting that large OEMs – such as VW, the largest OEM in Europe – are still relying on traditional combustion engine models to spur such growth.”

Volkswagen easily remained the largest car brand in Europe with both Audi and Skoda gaining market share for the larger Volkswagen Group. Toyota was the second-largest brand in Europe but lost market share, as did Mercedes-Benz. Peugeot was the only top-ten brand with weaker sales volumes in Europe in July 2023.

In contrast to Volkswagen, Stellantis continued to lose traction during the month, despite being the second largest European OEM. With 15.62% market share in July, the brand lost 3.5 points when compared to July 2022, and the gap in market share between VW Group and Stellantis is the largest it has been since the creation of Stellantis at the beginning of 2021. All of the top Stellantis brands had weaker sales than in 2022.

The 22 Chinese brands available in Europe sold only 25,564 new passenger cars across the region in July 2023 – 131% more than the number registered the year before. Over the same period, their market share doubled from 1.27% to 2.51%. However, 88% of the volume registered by Chinese manufacturers were from MG, Lynk & Co, and DR Automobiles – brands that are not positioning themselves as Chinese in origin.

Munoz, commented: “Reputation and brand awareness are the two biggest challenges that Chinese OEMs face, particularly in the West, and they’re very aware of that. Changing this perception will require a lot of work – more than simply offering a good product at a competitive price.”

Top 25 Best-Selling Car Models in Europe in 2023 (July)

The 25 best-selling car models in Europe in July 2023 were:

There were significant changes in the ranking of the best-selling car models in Europe in July 2023. The Volkswagen T-Roc took the top spot as it had done the year before. Despite being the top model, it experienced a decrease of 5% in volume. The Dacia Sandero ranked second and remained in a similar position to July 2022, and the Volkswagen Golf took third place – the best position it has secured so far this year. Its growth was driven both by its petrol versions, alongside business/fleet registrations.

Other top performers included the Renault Clio, Skoda Octavia, and Ford Puma. Among the latest models, the Renault Austral led with 6,103 units, becoming Renault’s fourth best-selling product, and almost outsold the Arkana with 6,138 units. The MG 4 was the fourth top-selling BEV of the month registering 5,890 units, racing ahead of its direct competitors – Volkswagen ID.3 and the Renault Megane with 4,241 and 3,380 units respectively.

Jeep’s Avenger became its new top-seller, registering almost 4,000 units. Meanwhile, the BMW sold 3,461 of its iX1 model, becoming the brand’s most popular BEV. Toyota registered 2,813 units of the Corolla Cross, which was significantly lower than the Corolla’s volume at 11,527 units.

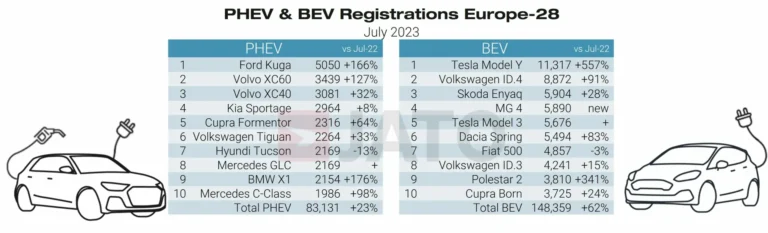

Best-Selling Electric and PHEV in Europe in 2023 (July)

The ten best-selling battery-electric (BEV) and Plug-In Hybrid Vehicles (PHEV) in Europe in July 2023 were:

The Tesla Model Y was again the most popular electric car in Europe in July 2023 although the lead was less pronounced than in many months earlier in the year when the Model Y was the top-selling car overall.

The Ford Kuga was the top-selling PHEV although PHEV were selling in low numbers compared to BEVs.

Europe Car Sales Statistics

→ Latest European Car Sales Statistics

- Full-Year 2023: Car Sales by Country, Brands, Top 50 Models, Top 20 Electric Car Models

- Car Sales and Market Analysis 2023: January, February, Q1, April, May, June HY, July, August, September, October.

- 2023 (Q3): Car Sales by Country, Brands

- Half-Year 2023: Car Sales by Country, Brands, Models

- Full-Year 2022: Car Sales by Country, Brands, Models, Electric